Tel: 60163067777 E: yap.rony.real.estate@gmail.com (REN 13403)

Cheras Heights @ Taman Bukit Cheras

Q Suite G1004 @ Bandar Sri Permaisuri (To Let)

*Please contact me for the latest update or availability. Thank you.

Private Caveat On Auctioned Property

If he/she applies for financing for his auctioned property, he/she will not be able to obtain any financing as no financier will grant financing where a caveat is lodged over the property. This is understandable as the land office may not register any charge in favour of the financier so long as the private caveat is not removed.

In such circumstances, the successful bidder must get the private caveat removed before the completion date of the auction sale, otherwise, any deposit paid will be forfeited and the property will be put up for auction again by the chargee bank. A private caveat may be removed by the person who lodged the caveat or by the Registrar or by a court order. To remove the caveat by court order, the successful bidder must prove to the court that he/she is aggrieved by the existence of the private caveat under Section 327 of the National Land Code 1965. If the caveat is removed through a court order, such order is to be served on the Land Registrar to effect the removal accordingly.

It’s The Right Time To Invest

Sunday, 02 Aug 2020

By ALLISON LAI

PETALING JAYA: Even as many consumers are cautious in purchasing high-ticket items in light of the Covid-19 pandemic, industry experts say the sale of properties and cars has been rising since June.

Real Estate and Housing Developers Association (Rehda) Malaysia national council member Tony Khoo Boon Chuan said property sales had picked up since June, thanks to lower interest rates and the extension of the government’s Home Ownership Campaign (HOC) until 2021.

“No doubt buyers are guarded when buying high-priced products.

“But others who are not affected financially also realize the time is here to buy or invest in a new property, ” he said in an interview.

Apart from the HOC’s 10% discount on the selling price, Khoo said buyers also enjoy incentives such as stamp duty exemption, free legal fees and freebies such as home security and alarm systems, additional cabling, fittings and fixtures.

“There are so many choices with perks and benefits in the market now for buyers.

“This is indeed the right time to invest, ” he said.

HOC is a government initiative in 2019 aimed at supporting homebuyers, and it has been reintroduced in June under the Penjana economic revival plan.

Khoo noted that the government’s exemption of real property gains tax for Malaysians for disposal of up to three properties had made it easy for property sales in the secondary market.

“This will certainly encourage a lot of investors and buyers who are looking to upgrade, ” he said.

In the automotive industry, both new and used cars have seen brisk sales in recent months, with foot traffic at showrooms has increased tremendously.

Malaysian Automotive Association (MAA) president Datuk Aishah Ahmad said new car sales improved to 42,000 in June, compared with 22,000 in May, following the government’s announcement to remove the sales tax for certain categories of vehicles.

“Many car companies are offering lots of discounts and attractive hire purchase rates to entice customers, ” she said.

Although many car buyers are still cautious, she said premium car purchases did not see many problems.

In fact, Aishah said MAA had readjusted the forecast of Malaysia’s total industry volume to 470,000 for this year, versus the earlier forecast of 400,000.

Federation of Motor and Credit Companies Association of Malaysia president Datuk Tony Khor Chong Boon agreed, adding that the used car market had also experienced tremendous growth in July.

“June sales were on par with full recovery following the recovery movement control order.

“July was very encouraging with 37,880 units sold, which is 25% higher than the same month last year, ” he said, adding that it was the highest monthly sales achieved in the last five years.

In contrast, he said used car sales only chalked up 303 units in April, when the usual monthly figure was between 30,000 and 35,000 units.

Khor said several factors contributed to the recent good vibes in the automotive industry, with measures introduced in the government’s economic revival plan shown to work.

“The moratorium has allowed some to have more money to spend, while the sales tax exemption has stimulated sales.

“Some buyers choose to get a car due to concerns about physical distancing and hygiene in public transport, ” he said, adding that used cars costing around RM30,000 were popular.

He noted that brisk sales of used cars resulted in a long waiting time for inspection at Puspakom, with a minimum wait time of at least five to seven days, and even 10 days or more at some locations.

When asked, Khor said it was hard to predict how long the good vibes would last because the real challenge would come when many borrowers are required to pay when the moratorium is lifted beginning October.

“To keep the market and economy stimulated, the government has to periodically come out with relevant measures and policies, ” he said.

Human resource executive CW Lim, who has been househunting for a few months, said he would make use of the discount and offers to buy a house in the Klang Valley.

“With the HOC, I’ll be able to save tens of thousand in downpayment, stamp duty fees and legal fees that could take me years to save up.

“Since my job and industry is not affected much, I hope I will soon own a house through these offers, ” said the 30-year-old from Klang.

Clinic nurse Farisha Azman, 29, who has been commuting to work from Subang Jaya to Shah Alam daily using the train, said she was in the process of buying a new car.

“Not having to worry about distancing on the train gives me peace of mind, ” she said.

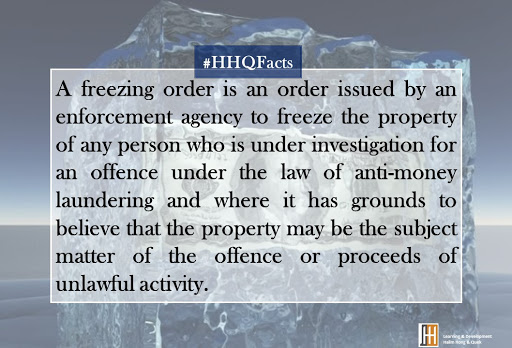

Issuance Of A Freezing Order Under AMLA

Depending on the terms of a freezing order, in general, upon the issuance of a freezing order, the owner of the property is prohibited from dealing with the property, such as selling, disposing of, charging, pledging, transferring or removing the property out of Malaysia. A freezing order may even require the owner of the frozen property to surrender his passport to the Director-General of Immigration to prevent him from leaving the country.

The enforcement agency should send a copy of the freezing order together with a list of the frozen property to the Public Prosecutor. Where a freezing order is made on monies deposited in a bank, the enforcement agency should also send a copy of the order together with a list of the frozen property to the Bank Negara Malaysia accordingly.

A freezing order is valid for 90 days from the date of the order if the person named in the freezing order has not been charged for an offence under the AMLA. Where there is no charge brought within the 90 days period, the freezing order shall no longer have an effect.

If there is no prosecution and yet the Public Prosecutor intends to forfeit the property on the satisfaction that the property is the subject matter of an offence under AMLA or being proceeds of unlawful activity, the Public Prosecutor may apply for a Court order of forfeiture of the property. The application must be made within 12 months from the date of a seizure order or where there is a prior freezing order, within 12 months from the date of the freezing order.

A freezing order is not to be confused with a seizure order. While a freezing order is usually issued to maintain the status quo of the property of the person who is under investigation for the offence of money laundering or terrorism financing, a seizure order, on the other hand, is an order issued by the Public Prosecutor upon satisfaction from the investigation that the movable property is the subject matter of an offence of money laundering or terrorism financing or is the proceeds of unlawful activity.

Q Suite F1014 @ Bandar Sri Permaisuri (To Let)

BNM Cuts OPR To 1.75%: 3 Significant Impacts On Malaysians

As reported by The Star, BNM shared: “For Malaysia, economic activity contracted sharply in the second quarter of the year, due to measures introduced to contain the pandemic globally and domestically. Following the gradual and progressive re-opening of the economy since early May, economic activities have begun to recover from the trough in the second quarter.

“The pace and strength of the recovery, however, remain subject to downside risks emanating from both domestic and external factors.

“These include the prospect of further outbreaks of the pandemic leading to re-impositions of containment measures, more persistent weakness in labour market conditions, and a weaker-than-expected recovery in global growth.

“The fiscal stimulus packages, alongside monetary and financial measures, will continue to underpin the improving economic outlook.”

To simplify it, when the economy is slowing down, BNM will reduce the OPR bands to encourage domestic spending to boost Gross Domestic Product (GDP) growth.

Okay, but what is OPR?

To those who aren’t exactly sure what is OPR - it’s the benchmark for commercial lending and deposit rates, which will be charged by the lending bank to its borrower bank for the borrowed funds.Additionally, the rate decided isn’t random but takes into account various economic indicating factors, such as inflation, economic growth, possible risks – basically, the overall economic outlook. BNM will adjust the rate according to how much money they want in circulation versus how much is tied up in savings.

How will it affect me, financially? Besides the weakening Ringgit...

1. Your cost of borrowing will be lessened.

A lower OPR would trigger the local banks to adjust their lending base rate (BLR) and base financing rate (BFR). This would then indirectly affect the interest rates - which means lowered costs for borrowing or refinancing an existing home loan.So, whether it’s a car loan, personal loan, credit cards or home loan, you will benefit from the OPR reduction. As a consumer, your spending capacity will increase and you’ll able to save. Not to mention, you’ll be able to make repayment for a shorter period.

Perhaps, you want to re-assess your savings or investment strategy so that you can get optimal returns. Having said that, if you’ve placed your money before the revised rate, it’ll remain the same.

3. It’s a great time to invest in Malaysian real estate investment trusts (M-REITs).

Affin Hwang Capital Research shared that over the long run, a lower OPR should also lower the finance costs of MREITs and lift earnings, although the impact on near-term profit to be minimal. The research house added that for 2020, the 25bps OPR rate cut is expected to have a muted impact of under 1% of the MREITs' earnings, it said.

Appointing An Executor In A Will

A testator of a will, namely the person who makes the will, shall appoint an executor to execute or carry out the intentions of a testator with respect to his property or other matters upon his death. The duties and responsibilities of an executor shall come into play upon the death of testator of a will in which he is named as the executor.

Upon the death of the testator, the executor needs to locate the will of the testator, apply to the court for a grant of probate, collect the assets, paying off your liabilities, distributing the assets according to the will and prepare a statement of account after distribution. In short, an executor takes up the role of a trustee holding the assets on trust for the beneficiaries until the assets are fully distributed. Executors are subject to the rights and responsibilities as provided under the Trustees Act 1949.

A testator may appoint up to four (4) executors at one time to jointly administer his estate upon his death. An executor does not have to be an individual as a trust company can also be appointed as an executor. Where a beneficiary named in a will is a minor, at least two executors need to be appointed as required under Section 4(2) of the Probate and Administration Act 1959.

A will needs to be signed and witnessed before two witnesses who are not the beneficiary or spouse of the beneficiary. As to whether a will can be witnessed by an executor of the same will, there is nothing to stop an executor from witnessing the signing of a will under Section 11 of the Wills Act 1959. However, where the executor is also the beneficiary, then the executor may not witness the signing of that will. Therefore, it is always advisable that the two witnesses shall not be beneficiary or executor of the same will.

Arcoris @ Mont' Kiara For Sale

Property: Serviced Residence Type: Intermediate Tenure: Freehold Built-up: 793 sq ft + 649 sq ft private roof garden Bedroom: 1 + 1 Bathro...

-

Property: Penthouse Type: Duplex Built-up: 1,700 sq ft Bedroom: 5 Bathroom: 3 Occupancy: Vacant Furnishing: Fully furnished Parking: ...

-

YouTube @ https://youtu.be/odqhSjHpdt0 Property: Shoplot Type: Corner & Intermediate Tenure: Freehold Land Area: 20' x 76.5' Bui...

-

1) 6 CapSquare @ KL 2) Binjai 8 Premium SOHO @ KLCC 3) Casa Residency @ Bukit Bintang 4) Ceriaan Kiara @ Mont' Kiara 5) Damai 88 @ Ampan...

-

Recruitment / Hiring Now / Looking for lucrative income? How to dominate the marketplace? Ever thought of getting the best of yourself in Re...

-

Property: 3 Storey Zero-Lot Bungalow Tenure: Freehold Land Area: 55' x 80' (4,400 sq ft) Built-up: 4,500 sq ft Bedroom: 6+1 Bathroo...

.jpeg)